Share price: $52.90

2025 Price Target: $93 | 17.5% IRR

Overview

Franklin Covey ($FC) is the leading employee training content provider in the world. Through their Enterprise Division (76% of sales) Franklin Covey provides training content, materials and consulting to enterprise customers. This division also houses the international license business in which FC collects high margin royalties from licensees who conduct FC workshops internationally. The Education Division (24% of sales) is a program designed to help build self-esteem and leadership qualities in K-6 schools.

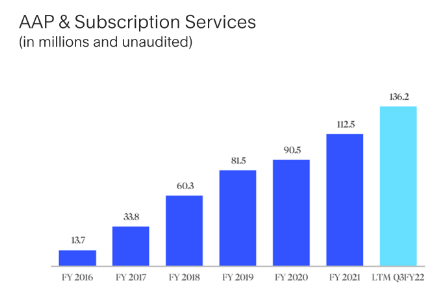

The Franklin Covey brand is well respected in the industry primarily due to the popular book “The Seven Habits of Highly Effective People” authored by Steven Covey. The company’s content offerings are derived from the principles in the book as well its long history of observations of corporate and individual behavior over time. Until 2016, FC offered these materials and consulting on an a la carte basis. However, management decided to combine all of FC’s content offerings into a single subscription package, with a product called the All Access Pass (AAP) which is now over 70% of Enterprise Division revenues. They took a similar approach with the Education Division introducing the Leader in Me (LIM) subscription offering.

As AAP and LIM have ramped, the legacy product has been cannibalized, obscuring the growth of All Access Pass. A classic good co bad co, pitch, what’s new here? As All Access Pass is now 81% of total enterprise revenue, this obscurement is now mostly behind the company and the true growth of its subscription revenue will be evident going forward.

Thesis

Franklin Covey is a $730M Market Cap company, $692M EV company trading at 12.5x 2023 EBITDA. This is a business that has no real apples to apples public comps with very little analyst coverage (3 small firms) tracking the name which leads to low sell side accuracy. As the business has transitioned away from a pay per use model to a subscription offering revenue visibility and durability improvement.

The AAP and LIM subscription services will drive mid teens revenue eventually accelerating to high teens top line growth. 80%+ gross margins, 20%+ ROIC with high switching costs evidenced by 90%+ revenue retention and growing average AAP ticket and growth in multi year contracts will drive 30%+ FCF growth to $4.65 in FCF per share in 2025. At a 5% FCF yield I arrive at $93/share or an 17.5% IRR. This is a strong return of capital story with a cash rich balance sheet and FCF machine.

Bears believe this business is highly at risk during a recession and the product life time is short. The sticky subscription business model with 90%+ revenue retention and growth in multi year contracts mitigate these risks.

The Enterprise Division

Franklin Covey’s largest segment, the Enterprise Division, has done $188M in TTM revenue (76% of sales), has 81% gross margins, 90%+ revenue retention and is growing 16% year over year. This business has undergone a shift from an a la carte legacy billing method to a subscription content offering. The legacy business has been declining over 10% per year since the introduction of the All Access Pass. AAP has dramatically improved FC’s business model improving unit economics through higher retention and ASPs. AAP has now flipped to the majority of segment revenues, driving topline acceleration and mid teens growth. Since being introduced in 2016, AAP has compounded revenue at 45% growing to $136M in revenue in the TTM period.

FC serves the $99B Corporate Learning market, which is growing 3% per year. Customers, such as Delta Airlines or Best Western pay FC to onboard employees, help instill their company culture throughout the organization or deliver teach-ins. The fluffy stuff that companies are leaning more toward and HR loves! AAP subscribers have unlimited access to all of FC content through a digital portal.

When management was rolling out AAP, they were clear that AAP subscription, which is nominally $200 per seat per year, but ARPU is somewhat lower given volume discounts for large clients, is the same price or cheaper as a single course from other players in the industry. As of Q3, the average AAP customer is spending $47K/year. In addition, FC has a 66% service attachment rate as customers pay to have FC client partners (CPs) deliver seminars, courses or provide consulting for course implementation.

The immediate and obvious retort is that a professional training business is the first expense to be cut in a recession and that this is a deeply cyclical business. While this may have been true for the lower margin legacy business, AAP has changed the game here. 42% of AAP contracts are multiyear in length and 58% of AAP subscription revenue is multiyear meaning those that are contracted for 2+ years are willing to shell out a lot of cash to FC for that contract. This revenue share is up from 37% in 2019 demonstrating that they’ve become increasingly more immersed in their clients’ training processes and have created some form of true stickiness. If a company is on board, they are really on board. So what is driving customers to sign up for non-refundable multiyear contracts?

Companies don’t have the time to design their own courses from scratch, which is time consuming and costly, because they are focused on competing for business. CEOs find themselves in the top job primarily because they are tremendous at either corporate politics or a certain function within the business. They are simply not well versed in instilling a cultural shift in an organization. FC’s value proposition is similar to M&A consultants. Installing and maintaining a culture is not an often-practiced skill, but it is critical to having a functional organization.In order to make sure it is done right, CEOs turn toward specialized consultants.

Romeen Sheth did a great job explaining the value proposition a consultant provides on Business Breakdowns on McKinsey, “The challenge when you’re inside a company or inside an organization, is when you see a problem, it’s unique to you. You’ve never done it before. And so McKinsey [read: a consultant company] wants to kind of augment its framing, If you have a problem and you haven’t faced it before, but you have an inclination that somebody else has, who are you going to go call when you need help? Management consulting, or that business of consulting, is basically this spark or this idea inside an organization that, hey, we have a problem, we haven’t really faced it before, but somebody out there probably has faced it before. And so as we need to solve it, how do we make sure we do so in the least expensive, fastest, and most efficient way?”

There are real switching costs here: as each new hire is trained in the FC program and learns its specific language, FC becomes more and more entrenched in the company’s culture. For congruency sake and to perpetuate culture clients stick with FC. As a VIC member put it, “Franklin Covey content and training becomes part of the organization’s modus operandi and to replace them, it would be somewhat analogous to Danaher ripping out the Danaher Business System.”

In a sense you can think of this as selling software, FC shells out an upfront cost to design the course once and delivers it over and over again with the only ongoing cost being T&E to get the CPs on site to deliver content and producing the books/materials. That IP has a long life and only needs to be updated every 3-5 years so maintenance capex is low. They invoice a year in advance and collect the cash up front which acts as a source of float to fund operations. It is not a traditional SaaS business as it has lower switching costs and client retention is likely in the mid 80% range (as opposed to normal SaaS at over 95%), but revenue retention is 90%+ (the big fish stay in the boat) and 100%+ when you consider cross selling.

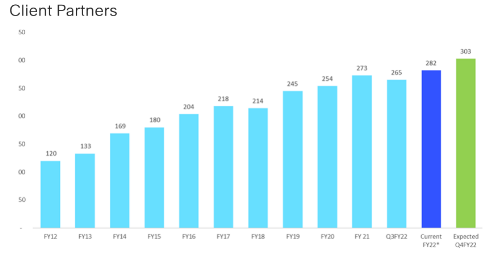

FC sizes the corporate market at 75,000 companies in the US and Canada, of which they already have ~20,000 accounts assigned to its 282 CPs. This leaves a significant runway for them to go after the other 55,000 firms. CEO Paul Walker stated on the Q3 calls, “We still have a tremendous amount of headroom to expand inside each of our All Access Pass subscribing clients. We mentioned on previous calls, very few of them are — we Enterprise with [meaning work with the whole organization]. We’re just in there with initial populations that are — while nice-sized, there was a lot of headroom to grow inside the existing All Access Pass clients in addition to adding new clients in the future.”

The biggest bottleneck that could impede AAP’s 20%+ growth for the foreseeable future is how quickly the company can find and train CPs. Since 2012 they have grown their CP count by more than 250% and project having 303 in total by year end. They have historically added 30 CPs a year, but management has talked about ramping to 50 new CPs annually in the future.

The AAP model is proven out with strong unit economics, as they continue to ramp CP hiring and win new clients/upsell in existing customers thanks to their brand, AAP will capture more of the consolidated growth. This business has relatively fixed costs, people are the largest asset. Bonuses, commissions and incentives may fluctuate a bit and T&E expenses will increase as salespeople get back out in the field, but overall inflation shouldn’t really affect them, as they have little supply chain/material costs. As they drive more revenue over that base at 30%+ incremental operating margins they will experience impressive margin expansion.

Education Division

Franklin Covey’s second business, Leader in Me, is housed under the Education Division. The Education Division has done $58M in TTM revenue, 24% of total sales, has 68% gross margins being driven higher by 77% incremental GM and 40%+ incremental operating margins. This business is growing 30% year over year and grew 12% through the pandemic.

LIM, the subscription offering that contributes 93% of Education revenue, is focused on building self-esteem and leadership qualities in K-6 elementary schools. It is a comprehensive program involving the children, parents, teachers, and school administration. The playbook is similar to their enterprise division: help schools build cultures that increase student performance and parental and teacher involvement. A LIM subscription provides access to digital versions of student leadership guides, leadership lessons, illustrated leadership stories, and a variety of other resources.

LIM suffered last year as a result of the pandemic and distance education. We have all heard our fair share of virtual education horror stories and kids being behind by a grade+ in some cases. As teachers tried to get any education they possibly could to the students, they had no time to implement new programs. Retention was high among current clients, but new business was hard to win.

LIM has added 600 new schools since August 2020 totaling 3,100 schools in the US and Canada. Last year, they retained 90% of schools. The switching costs of ripping out lesson plans and implementing new curriculum for schools is high. Selling to schools leads to some seasonality in FC’s overall numbers as the 4th quarter (August end) has a bump as schools finalize plans for the year and teachers have time off for professional days.

This segment has high incremental margins as SG&A and COGS are made up of direct costs of delivering content onsite at client locations, amortization of previously capitalized curriculum development costs and materials used in the production. There is little variable costs as most coaches are salaried. FC has pinned the K-12 Education segment as being a $59B opportunity, although that strikes me as a bit high. With global expansion and plodding along adding US and Canada schools this segment should continue to grow in the high teens over the next 5 years.

As long as organizations need some collective behavioral change that allows them to systematically and predictably move their performance and behavior up and to the right, FC will have a market. The competitive forces of capitalism ensure this. As Paul Walker stated on the Q3 earnings call, “Every organization has these righter and tighter challenges and opportunities, and they exist during both times of great opportunity and times of great challenge. The challenge organizations have in moving their operations and initiatives righter and tighter is a very durable one.”

Moat

Franklin Covey moat is fairly self explanatory. Once ingrained in a client’s culture it is hard to rip out. On the Enterprise side, new employees are constantly being on boarded and people need continual reminders for a culture to be instilled. On the Education side, Franklin Covey becomes involved in training staff and a part of the curriculum which rarely turns over. This stickiness is backed by the continual growth in multi year contracts are total revenue tied to multi year contracts since AAP and LIM introduction in 2016.

The FC brand, catalog of content and scale also play a major role. The Covey name is well recognized because of the 7 Habits of Highly Effective People and the constant content they push out. They have published over 35 books. With such a deep content offering built up over decades of publishing, they are tough to compete with. Direct competition is light, other content libraries including Skillsoft and LinkedIn exist, but they are markedly less robust.

Being a large-scale player in this space matters and is the reason why FC has made such a push to find new CPs. Having the organizational size to service multinational clients is a necessity. Having global reach allows truly multinational clients to scale FC content uniformly across their entire organization.

A principal at Robert Gregory, acquired by FC in 2017, backed this up saying, “I’m honestly not aware of anyone who I would say is truly competitive with FranklinCovey, just because of the sheer volume of content they have. A lot of people know who Stephen Covey is. They know the Covey name and Seven Habits of Highly Effective People. In my own experience, it’s really, really, tough to compete with. The sheer volume of the content that they’ve digitized and they’ve put into multiple languages and they’re selling all over the world.”

There is an opportunity for FC to share economies of scale here. They are already large relative to most players in its space and it is able to reinvest more to develop content and technology (the acquisition of Strive, a content delivery platform), this builds the value proposition of the subscription packages, which lures in more customers which reinforces their scale and so on.

So the bigger it gets, the harder it is for either internal or external providers of similar content and training to compete, because Franklin Covey reinvests substantially. A lot of the players in the industry are small and simply don’t have the budget or branding that FC does.

Management sees the opportunity too, “I think the fifth is maybe a little bit of a different point, and it’s something we’re focused on with our sales force is we don’t want to capitalize at somebody else’s expense. And we’ve seen consistently from the inception of All Access Pass that as we add more and more to it, it becomes an even more robust and powerful solution for our clients that they don’t need to work with as many vendor partners as they do. And so they can rationalize and consolidate others and actually double down with us.

By opting for an enterprise-wide contract with FC, customers save money in the aggregate on training costs, but FC grows its dollar share with the organization. Better to capture 100% of a $100 dollars then 50% of $150.

On a more nuanced level, FC has invested in translating AAP materials into numerous additional languages, which allows the AAP to be used effectively by multinational entities. It may sound insignificant, but as the 10th man pointed out in their Topicus write-up, “I read a Tegus transcript recently where a Shopify employee talks about the level of complexity involved when translating a user interface (UI) into other languages. Let’s say a small VMS company originally creates a product in English, and then looks to expand the offering in Japan. First, they need to translate all the words that users see into Japanese. But those Japanese characters take up a different space than English characters, so the UI needs to be reconfigured or risk looking horrible. Every time there is a product update, or new feature, somebody needs to translate and reconfigure the UI for every additional language that the software supports. As the UI grows in complexity and number of languages, the time required to manage the UI increases exponentially. Without scale, the unit cost of R&D can increase a lot.”

Competitive Threats and Risks

FC competes against LinkedIn Learning, Development Dimension International (DDI), GP Strategies Corp, SkillSoft, Coursera, Udemy Business, Harvard Business Publishing, Cornerstone, Workboard, and Korn Ferry, Character Counts, Responsive Classroom, 7 Mindsets, Second Step, and K12. These other content libraries are more supplemental products rather than the end to end solution FC is building.

Taking a moment to unpack the change in cyclicality of the business is key to the thesis. Management has been repeatedly asked, especially this quarter, about their exposure as companies cut costs heading into a recession. Theoretically training is cyclical and a discretionary item with no lock in. It is an easy cost to push off for a year until the sky is blue. This paragraph in their 10K does a good job laying out their own bear case:

“In challenging economic environments, our clients may reduce or defer their spending on new services and consulting solutions in order to focus on other priorities. Our business tends to lag behind economic cycles and, consequently, the benefits of an economic recovery following a period of economic downturn may take longer for us to realize than other segments of the economy. If there is a significant economic recession, the Enterprise division might suffer as companies cut funding for leadership training.”

However, we went through COVID quite possibly the worst case scenario imaginably for an in person professional training business. I’d say companies were presented with a decently pressing scenario, going out on a limb? Schools and business were virtual for months, but FC came out with more subscribers, a higher percentage of multi-year contracts than pre covid and their best margins ever. Customers such as airlines and hotels saw revenues drop 80%+ in a month, but they continued to double down during the pandemic.

Management discussed some examples of this in the Q3 call . One of the large airlines came to FC because they saw the pandemic as an opportunity to reboot their culture. They won a deal with Best Western to provide services to 2,000 properties in North America . A large hotel chain signed a 5 year contract with them during the pandemic. Management also referred to “a large industrial company” that originally had 100 APP users, but moved up to 1,000 then 3,000 then went enterprise wide with FC. At one point that organization had 30 different partners working with them and FC is now one of four providers as they scaled throughout the company.

FC saw sales get cut in half from 2008 to 2009, but because of the subscription model sales dropped only 12% in 2020 (and subscription sales grew). In 2021 consolidated sales were back in line with 2019 levels.

The increasing penetration of multi-year contracts is a quantitative data point of the above. What the company calls “unbilled deferred revenue” dollars of revenue that are contracted and will be recognized after the next twelve months also continues to grow at 20% year over year.

The strongest bear point I’ve come across is the question of “Let’s say an organization has worked with FC 5-8 years, do they exhaust or reach the limit of usefulness of the program?” Call me out for confirmation bias, if I’m falling victim here, but I lean toward no. FC is constantly developing new content, the competitive landscape is always changing so companies have to stay up to date and as companies grow and hire new employees they need that same cultural message.

Lastly, the general tightness of the labor market could be a bottleneck for FC. Future growth is constrained by slower than expected CP/salesperson.

Management and Capital Allocation

Franklin Covey has a long tenured and experienced management. Robert Whitman, Chairman of the board, has been a director of Franklin Covey since May 1997 and has served as Chairman of the Board of Directors since June 1999 and Chief Executive Officer of the Company from January 2000 until August 2021. He also owns 4% of shares outstanding.

CEO, Paul Walker, has been with FC for 22 years. He began his career with the company in 2000 in the role of business developer, and quickly moved to become a CP and then an Area Director. In 2007, Mr. Walker became General Manager of the North America Central Region. In 2014, Mr. Walker assumed responsibility for the Company’s UK operations in addition to his role as GM of the Central Region. In 2016, Mr. Walker relocated to the Company’s Salt Lake City, Utah headquarters where he served as Executive Vice President of Global Sales and Delivery and as President of the Company’s Enterprise Division until November 2019 when Paul was appointed President and Chief Operating Officer. He was the leader behind driving the AAP.

Stephen Young, CFO, has been in the role since 2002 and owns 1.4% of shares. This number isn’t great considering his long tenure with FC. Overall management compensation is tied to adjusted EBITDA and subscription service sales to push AAP growth.

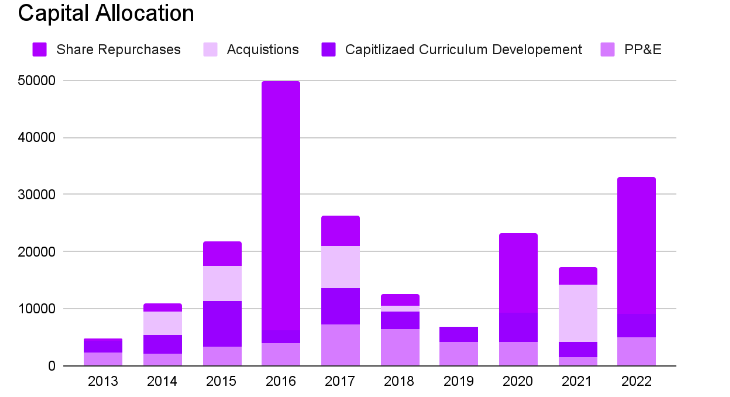

I believe that good capital allocation is lumpy. It highlights that a management team is assessing opportunity cost and is being opportunistic as opposed to robotic with their approach. FC exemplifies this. They have been opportunistic buyers of their stock with the largest purchases coming alongside key events such as the launch of AAP, the 2020 pandemic and this year as the stock traded below 11x EBITDA.

Management has been clear about their priorities of reinvesting in the business, as you can see through PP&E and capitalized curriculum development. They have also recently talked about returning large amounts of cash via buyback in the future.

To quickly touch on the Strive platform acquisition, this is expected to enable the integration and deployment of FC content, services, technology, and metrics to deliver AAP. In all it seems to make the delivery of materials easier and increase user experience

FC has historically terrific returns on invested capital of 20%+ (ROIC defined as (EBITA-Cash Taxes) / (Net Current Assets+Goodwill+ Net PP&E). The business takes very little incremental capital, in fact YTD they have generated more NOPAT while employing less capital. The main place for reinvestment is hiring new CPs and bolt on acquisitions. Capex and Capitalized software only make up 4% of revenues ($10-$15M annually). In a way this reminds me of a Moody’s esc business, that produces incredible free cash flow and needs little incremental capital to grow.

Valuation

Prior to the Q3 report FC was trading at 11x EBITDA and 20x FCF. Those multiples were undemanding for a business growing in the mid teens with high 30% incremental EBITDA margins. (Side note: Maybe I should work on these write ups faster, tough to see a 25%+ pop on a business you’re about to publish!) I think the market is still underestimating how much operating leverage this business really has. They need to employ zero incremental capital to grow and have a large net cash position on the balance sheet. They have the ability to pretty conservatively buyback 4% of shares out per year through 2025.

Management has guided to EBITDA growing $10M per year to $67M by 2025. I believe this is way too conservative. Even if they ramp investment in CP hiring like crazy I don’t see a way they don’t beat guidance. SG&A as a % of revenue should precipitously drop as revenue scales over the fixed cost base. Paul Walker said on the earnings call that the company is now targeting longer-term annual revenue growth reaching the teens and eventually close to 20%.

My base case model assumes $264M in revenue this year and a 15% revenue CAGR from 2023 to 2025. I have EBIT growing in the 40% per year due to significant margin expansion from 10% this year to 18% in 2025 which lifts FCF margins as well. This gets me to $4.65 in 2025 FCF per share with 4% of shares retired each year. A 20x FCF multiple seems fair for a business accelerating revenue with substantial margin expansion eating up shares. (Anywhere from a 15-20x multiple seems more than fair). These assumptions get me to an $93 share price by 2025 or a 17.5% IRR from today’s $53 price.

This is obviously one scenario of hundreds that could play out. Margin assumptions are the true drivers of this story and you can pick your favorite multiple. My range of outcomes is wide for FC ($70-$115 per share with an expected value at ~$90).

I’ve provided a link to my full model bull, bear and base case model here, instead of providing numerous screenshots. This way, readers can insert their own assumptions to understand the key drivers of the model.

Sources

Disclaimer

I own $FC Shares. I am not a financial advisor. These articles are for educational purposes only. Investing of any kind involves risk. Your investments are solely your responsibility and we do not provide personalized investment advice. It is crucial that you conduct your own research. I am merely sharing my opinion with no guarantee of gains or losses on investments. Please consult your financial or tax professional prior to making an investment.