Author: Ben Tewey

Published: 12/27/20

The Business

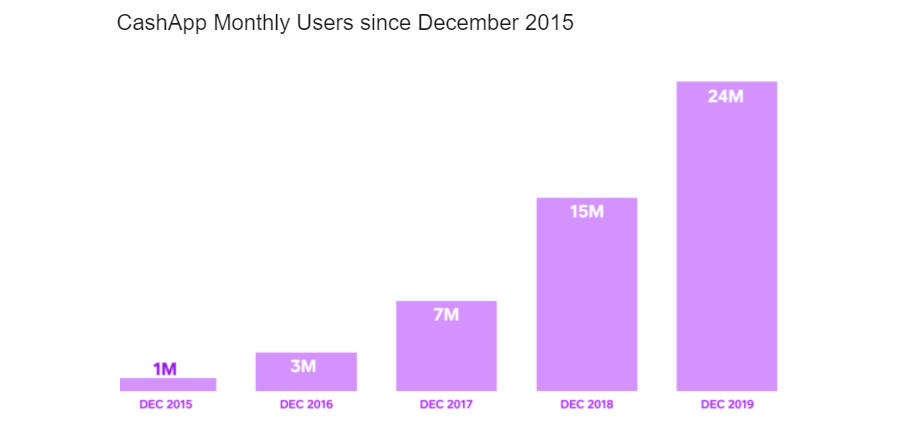

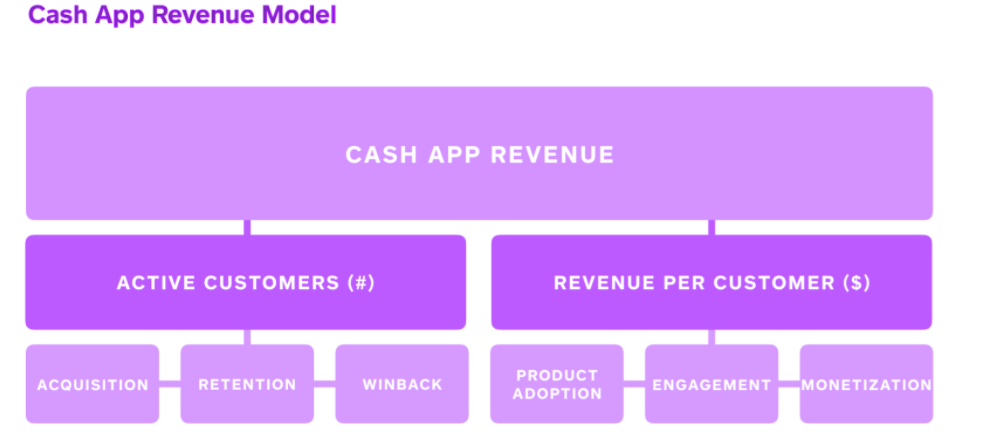

Square ($SQ) is an online payment processor that helps sellers start, run and grow their businesses. They combine software with affordable hardware to enable sellers to turn mobile and computing devices into payment and point-of-sale solutions. Their tools help sellers make informed business decisions through the use of analytics and reporting. Furthermore, sellers can manage orders, inventory, locations, and employees; engage customers and grow their sales; and gain access to business loans. Square ($SQ) takes a 2.75% cut from every payment processed through their devices. Square also developed Cash App, a mobile payment service and the #1 finance app on the App Store to rival Paypal’s Venmo ($PYPL). CashApp allows users to send money for free and invest in cryptocurrency and stocks. The app allows anyone to send, spend, and save money all from one app. As of December 2019, Cash App had approximately 24 million monthly active customers who had at least one cash inflow or outflow during a given month. This number has exponentially increased during the pandemic. Revenue from Cash App, Square Capital, and Instant Transfers for sellers currently comprise the majority of Square’s subscription and services-based revenue. Transaction-based revenue comes from a translation fee to Square sellers that is calculated based on a percentage of the total transaction amount processed. Product development expenses currently represent the largest component of Square’s operating expenses. Square is split into two ecosystems: sellers and individuals. They believe there is a 100B+ TAM for the sellers and a 60B+ TAM for the individual’s sect. Square has penetrated 3% and 2% of the respective TAMs. The real shock here is the TAM with CashApp; Square believes there is a 9 TRILLION total addressable market volume in consumer financial services in the United States ALONE. Below are tables highlighting Square’s growth over the last 5Q.

The Leadership

Jack Dorsey is the chairman, CEO, and one of the founders of Square as well the CEO of Twitter. Another co-founder Jim McKelvey is also the acting director of Square, it is a positive that co-founders of the business are in leadership positions as it demonstrates their ability to deliver on ideas as well as their passion for the company. Amrita Ahuja is the CFO of Square. Each person passes the “eye-test” of competent leaders, with high education, expertise, vision, transparency, integrity, and passion for the company. My only concern is that Jack Dorsey could be spread too thin between Twitter and Square, but the team around him at Square will more than make up for this.

Catalysts for Growth

Here at Vestrule, we believe that the future of Square lies in CashApp and bitcoin. Cash App’s growth, through the introduction of investing in both stocks and cryptocurrencies through the app, overall user growth, as a more professional and all-encompassing version of Paypal’s Venmo, expansion into new regions outside of the United States as well as an accelerated adoption of digital payment, is integral to the growth of Square as a whole. In addition to this the company’s investment in Bitcoin, we believe, will be a driving catalyst for the company as the rarity and therefore price of Bitcoin increases. In the short term, the reopening of small businesses to process more payments, as well as loans issued by Square to small businesses will be repaid will benefit the traditional part of Square’s business. We also believe in the traditional part of Square’s business continuing to grow as well; we would like to see Square expand into aiding larger business with payment processing which would, needless to say, help the profits. A higher volume of payments and as well as higher sums of money would be processed through Square hardware and software would assist the growth of Square. Also, Square has a Net Promoter Score (NPS) that has averaged more than 65 over the past four quarters, which is double the average score for banking providers. Their high NPS means their sellers recommend Square’s services to other small business owners, which we believe strengthens the Square brand and helps drive efficient customer acquisition. It is nice to see Square expanding into individual payment processing with the Square Card and Cash App as well with Square Capital which facilitates loans to qualified small businesses, this loan repayment occurs automatically through a fixed percentage of every card transaction a seller takes.

Cash App

Customers can use Cash App to store funds by receiving money from another Cash App customer through the app’s core peer-to-peer transfer service or by transferring money from a bank account. Nearly all Cash App accounts with a Cash Card also have a routing number and a unique account number, which allows customers to deposit their funds directly from their paycheck. These funds can then be sent to another customer through the app, spent anywhere that accepts cards using the Cash Card, withdrawn from an ATM using the Cash Card, or transferred to a bank account (either instantly for a fee or for free in 3-5 days). As of December 31, 2019, Cash App had stored balances of $676 million from its customers, representing an increase of 102% year over year.

Durability

As mentioned, Square continues to build upon their already strong brand, the Square ecosystem is all encompassing and hard to escape creating an attractive competitive moat. It’ll be incredibly difficult for an already existing Square customer to move away from them as it would take a full overhaul of the companies payment system, as well as spark the need to cut, paste, and glue multiple systems from various companies together. To be clear, Square has both software and hardware, so in essence a company can use the Square Register, which combines Square’s hardware, point-of-sale software, and payments technology, which acts as both a way to process to payments but also a mechanism to track customer data such as what products are being bought the most commonly, the payments processed in a period, and track payroll for employees. As demonstrated, Square’s ecosystem is all encompassing. For other payment processors, small businesses would have to stitch the payment stand from Company A with the software from Company B, with Square that is a nonissue. Square offers convenient implementation and is easy to set up, it is versatile for all sizes of businesses, and serves a diverse base of business from all sectors.

Into the Financials (2019 10Q and 2020 Q3 10Q):

Square has been growing Gross Payment Volume GPV consistently over the past 5 years. GPV is defined as the total dollar amount of all card payments processed by sellers using Square, net of refunds. Additionally, GPV includes Cash App activity related to peer-to-peer payments sent from a credit card and Cash for Business. Total Net Revenue has been growing incredibly fast YoY, over 43% between 2018 and 2019, we would like to see these margins come up a significant amount however. Total revenue has been increasing over 50% for the past 3 years. Specifically, subscription and services-based revenue for the year ended December 31, 2019 increased by $439.8 million or 74%, compared to the year ended December 31, 2018. This growth was driven primarily by Cash App, Square Capital, and Instant Transfers for sellers: the most exciting areas of the business to us here at VestRule. In addition to this, transaction based revenue was up 25% YoY and hardware revenue increased 23% YoY. The downside to this- total cost of revenue increased 42% YoY as well. Increases in cost of 24%, 38%, and 45% apply to transaction, subscription, and hardware respectively. Spending on the Square Card is growing as well as gross profit. Free cash flow to equity has been handled well and is positioned to grow. Taking a look at the balance sheet as of September 30th, 2020, Square passes the acid test, 1.7:1. It has, without question, been a focus of management to increase working capital (current assets – current liabilities) since 2016. This is a strong position to be in. Shareholder equity has been increasing year over year at an average of 43% with this percentage growing each year. Total liabilities have been increasing steadily since IPO, but this can be attributed to investment in growth, furthermore this growth in liabilities has been at an acceptable pace to stockholder’s equity. Lastly, total assets are almost double total liabilities. Square is in a very strong position for future growth.

Competitors

Here at VestRule, we see Paypal’s Venmo as the main competitor to Square’s Cash App. Credit Card Services such as Visa, Mastercard, Apple are also threats to Square’s business. Companies such as Stripe, Clover, Lightspeed Retail, Paypal’s Payment Depot & Swipe Simple, and Helcim rival Square in the seller ecosystem. For other risks, we kindly refer our readers to the “Risk Factors” section of Square’s most recent 10K report.

In short, we’re long

If you couldn’t tell already, at VestRule we are incredibly bullish on Square and its growth prospects. We are long as well as consistently adding to our position in Square on any pullback of 12% or more.

Disclaimer

I currently own shares of Square. I am not a financial advisor. These articles are for educational purposes only. Investing of any kind involves risk. Your investments are solely your responsibility and we do not provide personalized investment advice. It is crucial that you conduct your own research. I am merely sharing my opinion with no guarantee of gains or losses on investments. Please consult your financial or tax professional prior to making an investment.

Bibliography

2019 Year End Investor Presentation

September 2020 Investor Presentation